UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the SecuritiesSecurities Exchange Act of 1934 (Amendment No. )__)

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Preliminary Proxy Statement | |

| Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| Definitive Proxy Statement | |

| Definitive Additional Materials | |

| Soliciting Material Under Rule 14a-12 | |

Caterpillar Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Thanother than the Registrant)

| No fee required. | |||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | ||||

| (2) | ||||

| (3) | ||||

| (4) | ||||

| (5) | ||||

| Fee paid previously with preliminary materials: | |||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | ||||

| (2) | ||||

| (3) | ||||

| (4) | ||||

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

We are sending you these proxy materials in connection with Caterpillar’s solicitation of proxies, on behalf of its Board of Directors, for the 20172020 Annual Meeting of Shareholders (Annual Meeting). Distribution of these materials is scheduled to begin on May 2, 2017.1, 2020. Please submit your vote andor proxy by telephone, mobile device, Internet,internet, or, if you received your materials by mail, you can also complete and return your proxy or voting instruction form by mail.

| ||

| Potential Payments Upon Termination or Change in Control |

Frequently Asked Questions Regarding Meeting Attendance and Voting | ||

2020 PROXY STATEMENT 3

2020 PROXY STATEMENT 3

DEARTable of ContentsFELLOW SHAREHOLDERS,

D. JAMES UMPLEBY III Chairman and Chief Executive Officer “AS WE CONTINUE TO EXECUTE ON |

|

TableDear Fellow Shareholders,

On behalf of Contents

As partthe Board of Directors and our leadership transition,entire company, I cordially invite you to attend the board separated the rolesAnnual Meeting of chairman and chief executive officer.Shareholders on June 10, 2020, at 8 a.m. Central Time. This structure allows our new CEOmeeting will be entirely virtual in order to focus on running the business while, as non-executive chairman, I ensure the board is providing Jim the resources and counsel to make our company successful. We believe a strong and independent board is integraladhere to the long term successrecommendations of our company. Our movepublic health officials during the COVID-19 pandemic. The virtual format will give more shareholders the opportunity to splitparticipate in the chairmeeting, while ensuring everyone’s health and CEO role at this moment in time demonstrates that commitment. The board intends to review the appropriateness of this structure on a biannual basis.safety.

We regularly review the composition and qualifications of our board, and are delighted that Ray Wilkins, a former executive of AT&T Inc., joined our board in April 2017. Ray brings a broad array of leadership and business skills, including communications and information technology expertise that will serve the emerging needs of our company and augment the Board’s knowledge in these areas.

Shareholder relationships and outreach are a critical part of the board’s oversight. In addition to regular investor relations engagement, we meet annually with manyreceiving an update on the performance of the company, you will have the opportunity to vote on several items related to our institutional shareholders.business. Please refer to page 61 for information on how to participate in this year’s shareholder meeting.

The board of directors is honored to represent Caterpillar and our shareholders. We encourage you to review this proxy statement to learn more about your Board of Directors, our governance practices, compensation programs and philosophy, and other important items. Your vote is important. Please vote your shares ateither by virtually attending the upcoming annual meeting.meeting, by voting online separately, via your mobile phone, by telephone or by mail. Thank you for your ongoing investment in, and support of, Caterpillar as we continue to execute our enterprise strategy for long-term profitable growth and shareholder value.

Sincerely,

David L. CalhounD.JamesUmplebyIII

Chairman of the Boardand Chief Executive Officer

2020 PROXY STATEMENT 5

2020 PROXY STATEMENT 5

|

This summary does not contain all of the information you should consider.consider when casting your vote. You should read the complete proxy statement before voting.

|  |  |  |

TIME & | PLACE | RECORD DATE | ADMISSION |

8:00 a.m. June | |||

Virtual Meeting www.meetingcenter.io/268805716 Password: CAT2020 | The close of business on April | ||

To attend and register for the |

Proposal | Board’s Voting Recommendation | Page Reference | |

1 | Election of 11 Directors Named in This Proxy Statement | FOR Each Nominee | 10 |

2 | Ratification of our Independent Registered Public Accounting Firm | FOR | 24 |

3 | Advisory Vote to Approve Executive Compensation | FOR | 27 |

4 | Shareholder Proposal – Provide a Report of Lobbying Activities | AGAINST | 52 |

5 | Shareholder Proposal – Independent Board Chairman | AGAINST | 54 |

6 | Shareholder Proposal – Shareholder Action by Written Consent | AGAINST | 56 |

| PROPOSAL | BOARD’S VOTING RECOMMENDATION | PAGE REFERENCE | ||||

| 1 | Election of thirteen Directors named in this Proxy Statement | FOR each Nominee | 6 | |||

| 2 | Ratification of our Independent Registered Public Accounting Firm | FOR | 21 | |||

| 3 | Advisory Vote to approve Executive Compensation | FOR | 23 | |||

| 4 | Advisory Vote on the Frequency of Executive Compensation Votes | One Year | 51 | |||

| 5 | Approve the Amended and Restated Caterpillar Inc. 2014 Long-Term Incentive Plan | FOR | 51 | |||

| 6 | Shareholder Proposal – Provide a Report of Lobbying Activities | AGAINST | 60 | |||

| 7 | Shareholder Proposal – Decrease Percent of Ownership Required to Call Special Shareholder Meeting | AGAINST | 62 | |||

| 8 | Shareholder Proposal – Provide a Report of Lobbying Priorities | AGAINST | 63 | |||

| 9 | Shareholder Proposal – Include Sustainability as a Performance Measure under Executive Incentive Plans | AGAINST | 65 | |||

| 10 | Shareholder Proposal – Amend the Company’s Compensation Clawback Policy | AGAINST | 67 | |||

| 11 | Shareholder Proposal – Adopt a Permanent Policy that the Chairman be Independent | AGAINST | 69 | |||

2020 PROXY STATEMENT 6

2020 PROXY STATEMENT 6

Nominee and Principal Occupation | Independent | Age | Director | Other Public Company Boards | Caterpillar Committees | ||

AC | CHRC | PPGC | |||||

Kelly A. Ayotte Former U.S. Senator representing | Yes | 51 | 2017 | The Blackstone Group Inc. Boston Properties, Inc. News Corporation |

|

|  |

David L. Calhoun Presiding Director of Caterpillar Inc. President and CEO of The Boeing Company | Yes | 62 | 2011 | The Boeing Company

|

|

|  |

Daniel M. Dickinson Managing Partner of HCI Equity Partners | Yes | 58 | 2006 | None |  |

|

|

Juan Gallardo Chairman and Former CEO of Organización CULTIBA, S.A.B. de C.V. | Yes | 72 | 1998 | Grupo Aeroportuario del Pacifico, S.A.B. de C.V. Grupo Financiero Santander Mexico, S.A.B. de C.V. Organización CULTIBA, S.A.B. de C.V. |

|

|  |

William A. Osborn Former Chairman and CEO of Northern Trust Corporation and The Northern Trust Company | Yes | 72 | 2000 | Abbott Laboratories |  |

|

|

Debra L. Reed-Klages Former Chairman and CEO of Sempra Energy | Yes | 63 | 2015 | Chevron Corporation Lockheed Martin |

|  |

|

Edward B. Rust, Jr. Former Chairman and CEO of State Farm Mutual Automobile Insurance Company | Yes | 69 | 2003 | Helmerich & Payne, Inc. S&P Global Inc. |  |

|

|

Susan C. Schwab Professor at the University of Maryland School of Public Policy and Strategic | Yes | 65 | 2009 | The Boeing Company FedEx Corporation Marriott International, Inc.

|

|

|  |

D. James Umpleby III Chairman and CEO of Caterpillar Inc. | No | 62 | 2017 | Chevron Corporation |

|

|

|

Miles D. White Executive Chairman of the Board, Abbott Laboratories | Yes | 65 | 2011 | Abbott Laboratories McDonald’s Corporation |

|  |

|

Rayford Wilkins, Jr. Former CEO of Diversified Businesses | Yes | 68 | 2017 | Morgan Stanley |

|  |

|

|  |

|

|

| DIRECTOR | CAT COMMITTEES | ||||||

| NOMINEE AND PRINCIPAL OCCUPATION | INDEPENDENT | AGE | SINCE | OTHER PUBLIC COMPANY BOARDS | AC | CC | PPGC |

David L. Calhoun Independent Chairman Senior Managing Director of The Blackstone Group, L.P. | Yes | 59 | 2011 | Nielsen Holdings PLC |  | ||

Daniel M. Dickinson Managing Partner of HCI Equity Partners | Yes | 55 | 2006 | None |  | ||

Juan Gallardo Former CEO of Organización CULTIBA, S.A.B. de C.V. | Yes | 69 | 1998 | Grupo Aeroportuario del Pacifico, |  | ||

Jesse J. Greene, Jr. Instructor at Columbia Business School and former Vice President of Financial Management and Chief Financial Risk Officer of International Business Machines Corporation | Yes | 72 | 2011 | None |  | ||

Jon M. Huntsman, Jr. Former United States Ambassador to China and former Governor of Utah | Yes | 57 | 2012 | Chevron Corporation |  | ||

Dennis A. Muilenburg Chairman, President and CEO of The Boeing Company | Yes | 53 | 2011 | The Boeing Company |  | ||

William A. Osborn Former Chairman and CEO of Northern Trust Corporation | Yes | 69 | 2000 | Abbott Laboratories |  | ||

Debra L. Reed Chairman and CEO of Sempra Energy | Yes | 60 | 2015 | Halliburton Company |  | ||

Edward B. Rust, Jr. Former Chairman and CEO of State Farm Mutual Automobile Insurance Company | Yes | 66 | 2003 | Helmerich & Payne, Inc. |  | ||

Susan C. Schwab Professor at the University of Maryland School of Public Policy and a Strategic Advisor for Mayer Brown LLP; former United States Trade Representative | Yes | 62 | 2009 | FedEx Corporation |  | ||

Jim Umpleby CEO of Caterpillar Inc. | No | 59 | 2017 | None | |||

Miles D. White Chairman and CEO of Abbott Laboratories | Yes | 62 | 2011 | Abbott Laboratories |  | ||

Rayford Wilkins, Jr. Former CEO of Diversified Businesses at AT&T | Yes | 65 | 2017 | Morgan Stanley |  | ||

Chair

Member

|  Chair |  |  | Member |

2020 PROXY STATEMENT 7

2020 PROXY STATEMENT 7

Table of ContentsGOVERNANCEHIGHLIGHTS

|

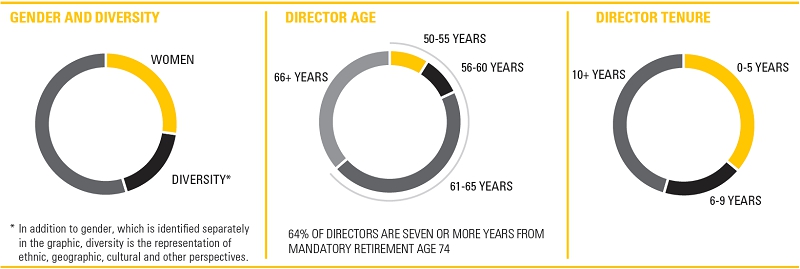

Our commitment to good corporate governance stems from our belief that a strong governance framework creates long-term value for our shareholders, strengthens Board and management accountability and builds trust in the Company and its brand. Our governance framework includes, but is not limited to, the following highlights:

Board and Governance Information | Board and Governance Information | |||||

Size of Board | 11 | |||||

Code of Conduct for Directors, Officers and Employees | Yes | |||||

Number of Independent Directors | 10 | Supermajority Voting | No | |||

Average Age of Directors | 64 | Proxy Access | Yes | |||

Average Director | 11 | Shareholder Action by Written Consent | No | |||

Annual Election of Directors | Yes | Shareholder Ability to Call Special Meetings | Yes | |||

Mandatory Retirement Age | 74 | Poison Pill | No | |||

Gender and Diversity | 45% | Stock Ownership Guidelines for Directors and Executive Officers | Yes | |||

Majority Voting in Director Elections | Yes | Anti-Hedging and Pledging Policies | Yes | |||

| Yes |

|

| |||

|  |

|

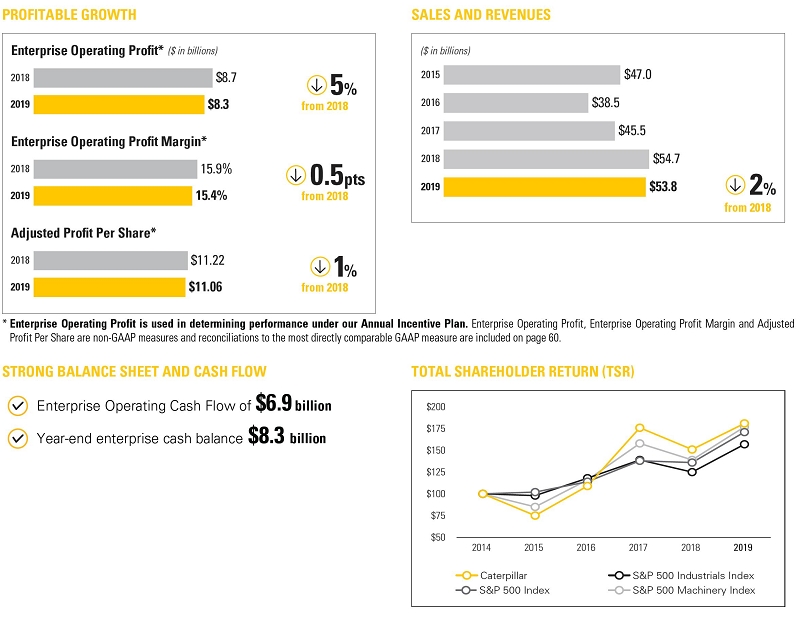

Table of Contents2019 PERFORMANCE HIGHLIGHTS

OPERATING PROFIT MARGIN |  PROFIT PER SHARE |  STRONG BALANCE SHEET |

15.4% | $10.74 | $6.2 billion |

Delivered operating margin of 15.4% in line with 2019 Investor Day Targets on 2% lower sales and revenues. | Profit per share was $10.74 in 2019, up from $10.26 in 2018. Adjusted profit per share* was $11.06 in 2019, compared with $11.22 in 2018. | Returned $6.2 billion to Shareholders in line with 2019 Investor Day Targets. The Company repurchased $4.0 billion of common shares and paid $2.1 billion in dividends, while ending 2019 with a cash balance of $8.3 billion. |

Adjusted Profit Per Share is a non-GAAP measure and a reconciliation to the most directly comparable GAAP measure is included on page 60.

2020 PROXY STATEMENT 8

2020 PROXY STATEMENT 8

510 Lake Cook Road, Suite 100

100 NE Adams StreetPeoria, Illinois 61629Deerfield, IL 60015

Phone (309) 675-1000(224) 551-4160

www.caterpillar.com

NOTICENOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

In light of the COVID-19 pandemic, the Board of Directors, after careful consideration, has decided to hold this year’s Annual Meeting exclusively online. If you plan to participate in the virtual meeting, please see the information below as well as the attendance and registration instructions on page 61. There will be no physical location for the Annual Meeting this year.

JUNE 10, 2020

8:00 a.m. Central Time

Website: www.meetingcenter.io/268805716

Password: CAT2020

Elect11 director nominees named in this Proxy Statement

Ratifyour independent registered public accounting firm for 2020

Approve, by non-binding vote, executive compensation

Voteon shareholder proposals

Addressanyotherbusiness that properly comes before the meeting

April 13, 2020

By Order of the Board of Directors

Suzette M. Long

Chief Legal Officer, General Counsel and Corporate Secretary

May 1, 2020

| ||||

PLEASE VOTE YOUR |

We encourage shareholders to vote promptly, as this will save the expense of additional proxy solicitation. You may vote in the following ways: |  |  |  |  | |||||||||||

|  |  |  | ||||||||||||

BY INTERNET |

| BY TELEPHONE | BY MAIL | ||||||||||||

vote online at |

|

|

| ||||||||||||

By Order of the Board of Directors

Important Notice Regarding the Availability of Proxy Materials for the Annual Shareholder meeting to be held on June 10, 2020. This Notice of Annual Meeting and Proxy Statement and the |

|

|

Table of ContentsDIRECTORS& GOVERNANCE

PROPOSAL 1 – ELECTION OF DIRECTORS

PROPOSAL SNAPSHOT |  |

What am I voting on? | |

Shareholders are being asked to elect | |

| Board Voting Recommendation: |

FORthe election of each of the Board’s director nominees. |

BOARDATTENDANCE-2019OVERVIEW OF OUR BOARD

|  |  |  |  |  |  |  |  |  |  |  | |||

Board | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 |

| 99% |

Audit | 10 |

|

| 10 |

| 9 |

|

|

|

|

| 4 |

| |

Compensation & | 6 |

| 3 |

|

|

| 6 |

|

|

| 6 | 3 |

| Attendance for

|

Public Policy & | 6 | 6 | 4 |

| 6 |

|

| 6 | 6 |

|

|

|

| |

* The Board of Directors approved certain committee membership changes effective April 12, 2019. As part of those changes, Mr. Calhoun left the Compensation & Human Resources Committee (CHRC) and joined the Public Policy & Governance Committee (PPGC) and Mr. Wilkins left the Audit Committee and joined the CHRC. Messrs. Calhoun and Wilkins attended all of their former and newly assigned committee meetings held during 2019. | ||||||||||||||

2020 PROXY STATEMENT 10

2020 PROXY STATEMENT 10

|  |  | ||||

Back to ContentsBOARD ATTENDANCE

|  |  |  |  |  |  |  |  |  |  |  |  | |

| Board | 9 | 9 | 9 | 9 | 9 | 8 | 9 | 9 | 9 | 7 | 9 | 9 | 8 |

| Audit | 11 | 11 | 11 | 11 | |||||||||

| Compensation & Human Resources | 7 | 7 | 7 | 7 | 7 | ||||||||

| Public Policy & Governance | 5 | 5 | 5 | 5 | 5 |

|

The Board’s policy is to encourage and expect that all directors should attend the annual shareholder meeting.each Annual Meeting of Shareholders. All directors attended the 2016 shareholder meeting.2019 Annual Meeting. The independent directors generally meet in executive session as part of each regularly scheduled Board meeting. Ed Rust, who was Caterpillar’sThe Board’s independent Presiding Director, in 2016,David L. Calhoun, presided over the Board’s executive sessions in 2016.2019.

|  |

Three new directors elected

Rotation of ContentsBoard committee chairs

Presiding Director elected

Expanded qualifications and diversity represented on Board

| |

| |

| |

| |

|

DIVERSITY OF SKILLS AND EXPERTISE

Our independent Board nominees offer a diverse range of skills and experience in relevant areas.

|  |  |  |  |  |  |  |  |  |  | |||

Caterpillar Board | 3 | 9 | 14 | 22 | 20 | 5 | 17 | 11 | 3 | 9 | 3 | 11 years | |

| Board of Directors Experience (other Boards) | • | • | • | • | • | • | • | • | • | • | • | 100% |

| Audit Committee Financial Expert |

|

| • |

| • |

| • |

|

|

|

| 100% of |

| CEO / Leadership | • | • | • | • | • | • | • | • | • | • | • | 100% |

| Business Development and Strategy |

| • | • | • | • | • | • | • | • | • | • | 91% |

| Government / Regulatory Affairs | • | • |

| • | • | • | • | • |

| • | • | 82% |

| Customer and Product Support Services |

| • | • | • | • | • | • |

| • | • | • | 82% |

| Finance & Accounting |

| • | • | • | • | • | • |

| • | • | • | 82% |

| Risk Management |

| • | • | • | • | • | • | • | • | • | • | 91% |

| Technology | • | • |

|

| • | • | • |

| • | • | • | 73% |

| Global Experience | • | • | • | • | • | • |

| • | • | • | • | 91% |

| Manufacturing / Logistics |

| • | • | • |

|

|

|

| • | • |

| 45% |

Gender and Diversity | • |

|

| • |

| • |

| • |

|

| • | 45% | |

Age | 51 | 62 | 58 | 72 | 72 | 63 | 69 | 65 | 62 | 65 | 68 | 64 years | |

GLOBAL EXPERIENCE 2020 PROXY STATEMENT 11

2020 PROXY STATEMENT 11

As shown by the yellow highlighted areas in the map below, our independent directors have international experience that aligns with Caterpillar’s global presence.Back to Contents

|

|

Table of ContentsDIRECTORCONTINUOUSEDUCATIONANDDEVELOPMENT

The Board has nominatedCompany places a high importance on the following individuals to stand for election for a one-year term expiring at the annual meetingcontinuous development of shareholders in 2018.

The number of persons comprising the Caterpillar Board of Directors is currently established as thirteen. If any of the Board’s nominees should become unavailable to serve as a Director prior to the Annual Meeting, the size of the Board and number of Board nominees will be reduced accordingly.

DIRECTOR CANDIDATE BIOGRAPHIES AND QUALIFICATIONS

its Board. Directors have beenopportunities for ongoing education and development through participation in meetings, subscriptions to relevant publications and attendance at activities and professional development training offered by associations such as the National Association of Corporate Directors and Lead Director Network. Directors receive specialized presentations from experts in the Company’s various businesses in the course of their current positions forservice. Since the past five years unless otherwise noted. Information is aslast annual shareholder meeting, these presentations have included updates on digital strategy, customer support, the operations of April 1, 2017.

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

|  |

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

|

|

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

|  |

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

|

|

| |||||

| |||||

| |||||

Compensation for non-employee directors for 2016 was comprised of the following components:

trends and issues relevant to their role. Directors are required to own Caterpillar common stock equal to five times their annual cash retainer. Directors have a five-year period from the date of their electionalso given development and education opportunities through speaking or appointment to meet the target ownership guidelines.

Directors may defer 50 percent or more of their annual cash retainer and stipend into an interest-bearing account or an account representing phantom shares of Caterpillar stock.

Directors that joined the Board prior to 2008 also participate in a Charitable Award Program, under which a donation of up to $500,000 will be made by the Company, in the director’s name, to charitable organizations selected by the director and $500,000 to the Caterpillar Foundation. Directors derive no financial benefit from the program.

| DIRECTOR COMPENSATION FOR 2016 | |||||||||||

| DIRECTOR | FEES EARNED OR PAID IN CASH | RESTRICTED STOCK UNITS1 | ALL OTHER COMPENSATION2 | TOTAL | |||||||

| David L. Calhoun | $150,000 | $125,015 | $ | — | $275,015 | ||||||

| Daniel M. Dickinson | $150,000 | $125,015 | $ | 32,696 | $307,711 | ||||||

| Juan Gallardo | $150,000 | $125,015 | $ | 13,051 | $288,066 | ||||||

| Jesse J. Greene, Jr. | $150,000 | $125,015 | $ | 2,000 | $277,015 | ||||||

| Jon M. Huntsman, Jr. | $150,000 | $125,015 | $ | — | $275,015 | ||||||

| Dennis A. Muilenburg | $150,000 | $125,015 | $ | — | $275,015 | ||||||

| William A. Osborn | $170,000 | $125,015 | $ | 13,051 | $308,066 | ||||||

| Debra L. Reed | $150,000 | $125,015 | $ | 2,100 | $277,115 | ||||||

| Edward B. Rust, Jr. | $175,000 | $125,015 | $ | 22,833 | $322,848 | ||||||

| Susan C. Schwab | $150,000 | $125,015 | $ | 15,000 | $290,015 | ||||||

| Miles D. White | $170,000 | $125,015 | $ | 8,000 | $303,015 | ||||||

1 As of December 30, 2016, the number of vested and non-vested options (NQs), RSUs and Phantom Shares held by each individual serving as a non-employee director during 2016 was: Mr. Calhoun: 12,197 (which consists of 1,672 RSUs and 10,525 Phantom Shares); Mr. Dickinson: 26,101 (which consists of 1,672 RSUs and 24,429 Phantom Shares); Mr. Gallardo: 34,400 (which consists of 5,833 SARs, 1,672 RSUs and 26,895 Phantom Shares); Mr. Greene: 1,672 RSUs; Mr. Huntsman: 1,672 RSUs; Mr. Muilenburg: 1,672 RSUs; Mr. Osborn: 2,036 (which consists of 1,672

|  |

RSUs and 364 Phantom Shares); Ms. Reed: 4,897 (which consists of 1,672 RSUs and 3,225 Phantom Shares); Mr. Rust: 34,083 (which consists of 1,672 RSUs and 32,411 Phantom Shares); Ms. Schwab: 11,091 (which consists of 1,672 RSUs and 9,419 Phantom Shares); and Mr. White: 7,802 (which consists of 1,672 RSUs and 6,130 Phantom Shares). Mr. Calhoun, Mr. Dickinson, Mr. Gallardo, Ms. Reed, Mr. Rust, Ms. Schwab and Mr. White deferred 100 percent of their 2016 retainer fee into phantom stock in the Directors’ Deferred Compensation Plan.

2 All Other Compensation represents amounts paid in connectionmeeting directly with the Caterpillar Foundation’s Directors’ Charitable Award Program and the Caterpillar Political Action Committee Charitable Matching Program (CATPAC’s PACMATCH program) and administrative fees associated with the Directors’ Charitable Award Program. All outside directors are eligible to participate in the Caterpillar Foundation Matching Gift Program and eligible directors may participate in the CATPAC’s PACMATCH program annually. The Caterpillar Foundation will match contributions to eligible two year or four year colleges or universities, arts and cultural institutions and public policy or environmental organizations, up to a maximum of $2,000 per eligible organization per calendar year. As part of CATPAC’s PACMATCH program, Caterpillar Inc. will contribute to two charities on behalf of eligible members of the Board of Directors. The annual CATPAC’s PACMATCH contribution limit is $5,000 so the match, per person, would not exceed $5,000. The amounts listed represent the matching contributions as follows: Mr. Dickinson $2,250, Mr. Greene $2,000, Ms. Reed $2,100, Mr. Rust $13,500, Ms. Schwab $15,000management and Mr. White $8,000. For directors eligibleother employees, Company dealers and customers to participate in the Directors’ Charitable Award Program, the amounts represented include the insurance premium and administrative fees. The premium and administrative fees are as follows: Mr. Dickinson $30,446, Mr. Gallardo $13,051, Mr. Osborn $13,051 and Mr. Rust $9,333.

BOARD ELECTION AND LEADERSHIP STRUCTURE

Directors are elected at each annual meeting to serve for a one-year term. In uncontested elections, directors are elected by a majority of the votes cast for such director. If an incumbent director does not receive a greater number of “for” votes than “against” votes, then such director must tender his or her resignation to the Board. In contested elections, directors are elected by a plurality vote. Directors must retire at the end of the calendar year in which they reach the age of 72.

On January 1, 2017, Jim Umpleby, formerly Group President with responsibility for Energy & Transportation, succeeded Douglas R. Oberhelman as Chief Executive Officer and was appointed as a member of our Board of Directors. In planning for the succession of Mr. Oberhelman, the Public Policy and Governance Committee (PPGC) and the Board carefully reviewed the Board’s leadership structure and determined that it would be appropriate to separate the roles of the Chairman and Chief Executive Officer and to appoint an independent Chairman. Accordingly, on April 1, 2017 David L. Calhoun became our independent Chairman.

The Board has no fixed policy on whether or not to have a non-executive chairman. The Board believes this determination should be made based onbetter understand the Company’s best interests in light of the circumstances at the timeoperations and experience. The PPGC and the Board believe that this leadership structure is the most appropriate one for the Company at this time, as it allows Mr. Umpleby to focus on the day-to-day management of the business and on executing our strategic priorities, while allowing Mr. Calhoun to focus on leading the Board, providing its advice and counsel to Mr. Umpleby, and facilitating the Board’s independent oversight of management.

The Board believes it is important to maintain flexibilityalso through attending industry trade shows such as to the Board’s leadership structure. The Board will continue to regularly review its leadership structure and exercise its discretion in recommending an appropriate and effective framework on a case-by-case basis, taking into consideration the needs of the Board and the Company at such time.CONEXPO.

DUTIES AND RESPONSIBILITIES OF CHAIRMAN

CORPORATE GOVERNANCE GUIDELINES AND CODE OF CONDUCT

Our Board has adopted Guidelines on Corporate Governance Issues (Corporate Governance Guidelines), which are available on our website at www.caterpillar.com/governance. The guidelines reflect the Board’s commitment to oversee the effectiveness of policy and decision-making both at the Board and management level, with a view to enhancing shareholder

|

|

Table of ContentsBOARD’SROLEINRISKOVERSIGHT

value over the long-term. Caterpillar’s code of conduct is called Our Values in Action. Integrity, Excellence, Teamwork, Commitment and Sustainability are the core values identified in the code and are the foundation for Caterpillar’s corporate existence. Our Values in Action apply to all members of theBoard and to management and employees worldwide. These values embody the high ethical standards that Caterpillar has upheld since its formation in 1925. Our Values in Action is available on our website at www.caterpillar.com/code.

The Board conducts an annual self-evaluation to determine whether the Board and its committees are functioning effectively. In 2016, the Presiding Director contacted each Board member to solicit their feedback. The Public Policy & Governance Committee also developed a discussion outlinethat was circulated to the Board members in advance of their year-end meeting. The Presiding Director then led a discussion during the Board’s private session. Each of the committees of the Board followed a similar process.

The Board has three standing committees: Audit; Compensation; and Public Policy and Governance. Each committee meets periodically throughout the year, reports its actions and recommendations to the Board, receives reports from management, annually evaluates its performance and has the authority to retain outside advisors at its discretion. The current primary responsibilities of each committee are summarized below and set forth in more detail ineach committee’s written charter, which can be found on Caterpillar’s website at www.caterpillar.com/governance. All committee members are independent under Company, NYSE and SEC standards applicable to Board and committee service, and the Board has determined that each member of the Audit Committee is an “audit committee financial expert” as defined under SEC rules.

| |||

|  |

| |||

| |||

BOARD’S ROLE IN RISK OVERSIGHT

The Board has oversight for risk management with a focus on the most significant risks facing the Company, including strategic, operational, financial and legal compliance risks. The Board’s risk oversight process builds upon management’s risk assessment and mitigation processes, which include an enterprise risk management program, regular internal management disclosure and compliance committee meetings, a code of business conduct that applies to all employees, executives and directors, quality standards and processes, an ethics and compliance officeandprogram and comprehensive internal audit processes. The Board’s risk oversight role also includes the selection and oversight of the independent auditors. The Board implements its risk oversight function both as a full Board and through delegation to Board committees, which meet regularly and report back to the full Board. The Board has delegated the oversight of specific risks to Board committees that align with their functional responsibilities.

|

|

DIRECTOR NOMINATIONS AND EVALUATIONS

|

internal controls, the internal audit program, the independent auditor, the compliance program, and the information security program. The AC assesses cybersecurity and information technology risks and the controls implemented to monitor and mitigate these risks. The Chief Information Officer attends all bimonthly AC meetings and provides cybersecurity updates to the AC and Board. The Compensation and Human Resources Committee (CHRC) monitors and assesses risks associated with the Company’s employment and compensation policies and practices. The Public Policy and Governance Committee (PPGC) oversees various governance matters and risks related to public policy and environmental, health and safety matters affecting the Company.

DIRECTORNOMINATIONSANDEVALUATIONS

PROCESS FOR NOMINATING AND EVALUATING DIRECTORS

The PPGC solicits and receives recommendations for potential director candidates from shareholders, management, directors and other sources. In its assessment of each potential candidate, the PPGC considers each candidate’s professional experience, integrity, honesty, judgment, independence, accountability, willingness to express independent thought, understanding of the Company’s business and other factors that the PPGC determines are pertinent in light of the current needs of the Board. Candidates must have successful leadership experience and stature in their primary fields, with a background that demonstrates an understanding of business affairs as well as the complexities of a large, publicly-held company. In addition, candidates must have a demonstrated an ability to think strategically and make decisions with a forward-looking focus and the ability to assimilate relevant information on a broad range of complex topics. In evaluating director candidates, the PPGC also considers key skills and experience related to the Company’s strategy for long-term profitable growth, which identifies services, expanded offerings and operational excellence as primary focus areas. Moreover, candidates must have the ability to devote the time necessary to meet a director’s responsibilities and serve on no more than four public company boards in addition to Caterpillar.

The Board values diversity of talents, skills, abilities and experiences and believes that Board diversity of all types enhances the Company’s Board.performance of the Board and provides significant benefits to the Company. Accordingly, the PPGC takes into account the diversity of the Board in selecting new director candidates.

DIRECTOR RECRUITMENT PROCESS 2020 PROXY STATEMENT 12

2020 PROXY STATEMENT 12

CANDIDATE RECOMMENDATIONS |  | PPGC |  | BOARDOFDIRECTORS |  | SHAREHOLDERS | ||

from Shareholders, |  | Discusses Qualifications Enterprise Strategy Board Diversity Interviews RecommendsNominees |  | Discusses PPGC Analyzes Selects Nominees |  | Vote on Nominees | ||

The following table summarizes certain key characteristics of the Company’s businesses and the associated qualifications, skills and experience that the PPGC believes should be represented on the Board.

BUSINESS CHARACTERISTICS | QUALIFICATIONS, SKILLS AND EXPERIENCE | |

■ The Company is a global manufacturer with products sold around the world. | ■ Manufacturing or logistics operations experience ■ Broad international exposure | |

■ Technology and customer and product support services are | ■ Technology experience ■ Customer and product support experience | |

■ The Company’s businesses undertake numerous transactions in many countries and in many currencies. | ■ Diversity of race, ethnicity, gender, cultural background or professional experience ■ High level of financial literacy ■ Mergers and acquisitions experience | |

■ Demand for many of the Company’s products is tied to conditions in the global commodity, energy, construction and transportation markets. | ■ Experience in the evaluation of global economic conditions ■ Knowledge of commodity, energy, construction or transportation markets | |

■ The Company’s businesses are impacted by regulatory requirements and policies of various governmental entities around the world. | ■ Governmental and international trade | |

■ The Board’s responsibilities include understanding and overseeing the various risks facing the Company and ensuring that appropriate policies and procedures are in place to effectively manage risk. | ■ Risk oversight/management expertise ■ Relevant executive and leadership experience ■ Cybersecurity experience |

|  |

Table of ContentsNOMINATIONS FROM SHAREHOLDERS

The Board values diversity of talents, skills, abilities and experiences and believes that Board diversity of all types provides significant benefits to the Company. Although the Board has no specific diversity policy, the PPGC considers the diversity of the Board and potential director candidates in selecting new director candidates.

|

The PPGC considers unsolicited inquiries and director nominees recommended by shareholders in the same manner as nominees from all other sources. Recommendations should be sent to the CorporateSecretary at 510LakeCookRoad,Suite100, NE Adams Street, Peoria, Illinois 61629.Deerfield,IL60015. Shareholders may nominate a director candidate to serve on the Board byfollowingby following the procedures described in our bylaws. Deadlines for shareholder nominations for Caterpillar’s 2018 annual meeting2021 Annual Meeting of shareholdersShareholders are included in the “Shareholder Proposals and Director Nominations for the 20182021 Annual Meeting” section on page 73.58.

The number of persons comprising the Caterpillar Board of Directors is currently established as 11. If any of the Board’s nominees should become unavailable to serve as a Director prior to the Annual Meeting, the size of the Board and number of Board nominees will be reduced accordingly.

2020 PROXY STATEMENT 13

2020 PROXY STATEMENT 13

DIRECTORCANDIDATEBIOGRAPHIESANDQUALIFICATIONS

Directors have been in their current positions for the past five years unless otherwise noted. Information is as of April 14, 2020. The Board has nominated the following individuals to stand for election for a one-year term expiring at the Annual Meeting of Shareholders in 2021.

| KELLY A. AYOTTE Former U.S. Senator representing New Hampshire Age 51 Director since: 2017 INDEPENDENT | OTHER CURRENT DIRECTORSHIPS: ■ The Blackstone Group Inc. ■ Boston Properties, Inc. ■ News Corporation | CATERPILLAR BOARD COMMITTEE ■ Public Policy and Governance OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: ■ Bloom Energy Corporation |

FormerSenatorAyotte provides the Board with leadership experience and in-depth knowledge in the areas of public policy, government and law from her experience as U.S. Senator, Attorney General, Deputy Attorney General, and Chief of the Homicide Prosecution Unit for New Hampshire. She offers valuable insights on important public policy issues from her service on the Senate Commerce, Science and Transportation Committee and financial experience from her service on the Senate Budget Committee. In addition to the directorships mentioned above, former Senator Ayotte currently serves on three nonprofit boards that focus on human rights and other global issues. | |||

| DAVID L. CALHOUN President and CEO of The Boeing Company (aircraft and defense) Age 62 Director since: 2011 INDEPENDENT Presiding Director | OTHER CURRENT DIRECTORSHIPS: ■ The Boeing Company | CATERPILLAR BOARD COMMITTEE ■ Public Policy and Governance, Chair OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: ■ Gates Industrial Corporation plc ■ Nielsen Holdings plc |

Mr.Calhoun has been President and CEO of The Boeing Company since 2020. Prior to leading Boeing, Calhoun served as senior managing director and head of portfolio operations at The Blackstone Group from 2014. Previously, he also served as executive chairman of the board for Nielsen Holdings from January 2014 to January 2016 and served as Nielsen CEO for seven years beginning in 2006. Mr. Calhoun began his career at The General Electric Company (GE), where he rose to vice chairman of the company and president and chief executive officer of GE Infrastructure, its largest business unit. During his 26 years at GE, he held a number of operating, finance and marketing roles, and led multiple business units, including GE Transportation and GE Aircraft Engines.He provides valuable insight and perspective to the Board on strategic and business matters, stemming from his extensive operational, executive and management experience with Blackstone and Nielsen and his previous roles at General Electric (GE). He provides valuable insight and perspective to the Board on strategic and business matters, stemming from his extensive operational, executive and management experience. The Board elected Mr. Calhoun as Presiding Director in 2018. | |||

2020 PROXY STATEMENT 14

2020 PROXY STATEMENT 14

| DANIEL M. DICKINSON Managing Partner of HCI Equity Partners (private equity firm) Age 58 Director since: 2006 INDEPENDENT | OTHER CURRENT DIRECTORSHIPS: ■ None | CATERPILLAR BOARD COMMITTEE ■ Audit, Chair OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: ■ None |

Mr.Dickinson has served as Managing Partner of HCI Equity Partners since 2001. His experience in mergers and acquisitions, private equity business and investment banking provides important insights for evaluating investment opportunities. Mr. Dickinson’s significant financial experience, both in the U.S. and internationally, contributes to the Board’s understanding and ability to analyze complex issues. His experience as a former director of a large, publicly-traded multinational corporation enables him to provide meaningful input and guidance to the Board. | |||

| JUAN GALLARDO Chairman and Former CEO of Organización CULTIBA, S.A.B. de C.V. (beverage industry) Age 72 Director since: 1998 INDEPENDENT | OTHER CURRENT DIRECTORSHIPS: ■ Grupo Aeroportuario del Pacifico, S.A.B. de C.V. ■ Grupo Financiero Santander Mexico, S.A.B. de C.V. ■ Organización CULTIBA, S.A.B. de C.V. | CATERPILLAR BOARD COMMITTEE ■ Public Policy and Governance OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: ■ LafargeHolcim Ltd. |

Mr.Gallardo is Chairman of Organización CULTIBA, S.A.B. de C.V. where he retired as CEO in February 2016. Mr. Gallardo resides in Mexico, where Caterpillar has a presence. The Board believes Mr. Gallardo’s international business experience, particularly in Latin America, is important for the Company’s understanding of these markets. His extensive background and active engagement in trade-related issues also contributes to the Board’s expertise. In addition, his experience as a CEO and director of other large, publicly-traded multinational corporations enables him to provide meaningful input and guidance to the Board in many areas, including risk oversight and strategy. | |||

| WILLIAM A. OSBORN Former Chairman and CEO of Northern Trust Corporation and The Northern Trust Company (financial services) Age 72 Director since: 2000 INDEPENDENT | OTHER CURRENT DIRECTORSHIPS: ■ Abbott Laboratories ■ General Dynamics Corporation | CATERPILLAR BOARD COMMITTEE ■ Audit OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: ■ None |

Mr.Osborn retired as Chairman in 2009 and as CEO in 2008 of Northern Trust Corporation and The Northern Trust Company. He provides the Board with valuable financial expertise and experience. In addition, his experience as a CEO and director of other large, publicly-traded corporations enables him to provide meaningful input and guidance in many areas, including public company governance, corporate finance and risk oversight. | |||

2020 PROXY STATEMENT 15

2020 PROXY STATEMENT 15

| DEBRA L. REED-KLAGES Former Chairman and CEO of Sempra Energy (energy infrastructure and utilities) Age 63 Director since: 2015 INDEPENDENT | OTHER CURRENT DIRECTORSHIPS: ■ Chevron Corporation ■ Lockheed Martin Corporation | CATERPILLAR BOARD COMMITTEE ■ Compensation and Human Resources OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: ■ Halliburton Company ■ Oncor Electric Delivery Company LLC ■ Sempra Energy |

Ms.Reed-Klages retired as Chairman of the Board and CEO of Sempra Energy in 2018, having served in these roles since 2012 and 2011, respectively. The power, oil and gas industries are key end-user markets for Caterpillar products and the Board believes Ms. Reed-Klages’ background provides valuable insights into trends in these industries. In addition, her experience as a CEO and director of other large, publicly-traded corporations enables her to provide meaningful input and guidance to the Board. Ms. Reed-Klages’ areas of expertise include commodity markets, sustainability and international operations. | |||

| EDWARD B. RUST, JR. Former Chairman and CEO of State Farm Mutual Automobile Insurance Company (insurance) Age 69 Director since: 2003 INDEPENDENT | OTHER CURRENT DIRECTORSHIPS: ■ Helmerich & Payne, Inc. ■ S&P Global Inc. | CATERPILLAR BOARD COMMITTEE ■ Audit OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: ■ None |

Mr.Rust retired as Chairman in 2016 and as CEO in 2015 of State Farm Mutual Automobile Insurance Company. His financial and business experience is valuable to the Board. His role as a past Chairman of the U.S. Chamber of Commerce, CEO of a major national corporation and experience as a director of other large, publicly-traded multinational corporations enables him to provide meaningful input and guidance to the Board, including with respect to public company governance and strategy. In addition, his extensive involvement in education improvement complements the Company’s culture of social responsibility. | |||

| SUSAN C. SCHWAB Professor at the University of Maryland School of Public Policy and Strategic Advisor for Mayer Brown LLP (global law firm) Age 65 Director since: 2009 INDEPENDENT | OTHER CURRENT DIRECTORSHIPS: ■ The Boeing Company ■ FedEx Corporation ■ Marriott International, Inc. | CATERPILLAR BOARD COMMITTEE ■ Public Policy and Governance OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: ■ None |

AmbassadorSchwab has been Professor at the University of Maryland School of Public Policy since 2009 and Strategic Advisor for Mayer Brown LLP since 2010. She held various positions previously, including U.S. Trade Representative (member of the President’s Cabinet) and Assistant Secretary of Commerce. Ambassador Schwab brings extensive knowledge, insight and experience on international trade and commerce issues to the Board. Her educational experience and role as the U.S. Trade Representative provide important insights for the Company’s global business model and long-standing support of open trade. In addition, her experience as a director of other large, publicly-traded multinational corporations enables her to provide meaningful input and guidance to the Board, including on strategy and the evaluation of global economic conditions. | |||

2020 PROXY STATEMENT 16

2020 PROXY STATEMENT 16

| D. JAMES UMPLEBY III Chairman and CEO of Caterpillar Inc. Age 62 Director since: 2017 MANAGEMENT | OTHER CURRENT DIRECTORSHIPS: ■ Chevron Corporation | CATERPILLAR BOARD COMMITTEE ■ None OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: ■ None |

Mr.Umpleby has been CEO of Caterpillar since January 1, 2017, and was elected Chairman of the Board in 2018. He served as a Group President of Caterpillar from 2013 to 2016 with responsibility for Caterpillar’s Energy & Transportation segment and served as a Caterpillar Vice President and President of Solar Turbines from 2010 to 2012. Mr. Umpleby developed a deep knowledge of the Company and its end markets by serving in a wide range of leadership roles. He has extensive international experience and has worked in manufacturing, engineering, marketing, sales and services. Mr. Umpleby’s strategic planning and execution skills, along with his extensive industry experience, enables him to provide effective leadership of the Company and the Board. | |||

| MILES D. WHITE Executive Chairman of the Board, Abbott Laboratories (medical devices and biotechnology) Age 65 Director since: 2011 INDEPENDENT | OTHER CURRENT DIRECTORSHIPS: ■ Abbott Laboratories ■ McDonald’s Corporation | CATERPILLAR BOARD COMMITTEE ■ Compensation and Human Resources, Chair OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: ■ None |

Mr.White serves as Executive Chairman of the Board of Abbott Laboratories. Mr. White, who joined Abbott in 1984, served as Abbott’s Chairman and CEO from 1999 to 2020. His experience leading a large, complex multinational company provides important insight to the Board. Mr. White’s skills include knowledge of cross-border operations, strategy and business development, risk assessment, finance, leadership development and succession planning, and corporate governance matters. In addition to his role with Abbott Laboratories, Mr. White’s experience as a director of other large, publicly-traded multinational corporations enables him to provide meaningful input and guidance to the Board. | |||

| RAYFORD WILKINS, JR. Former CEO of Diversified Businesses at AT&T Inc. (telecommunications) Age 68 Director since: 2017 INDEPENDENT | OTHER CURRENT DIRECTORSHIPS: ■ Morgan Stanley ■ Valero Energy Corporation | CATERPILLAR BOARD COMMITTEE ■ Compensation and Human Resources OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: ■ None |

Mr.Wilkins retired as CEO of Diversified Businesses at AT&T Inc. in 2012. His expertise and oversight experience in the information technology arena is valuable to the Board. In addition, Mr. Wilkins’ experience as a CEO and director of other large, publicly-traded corporations enables him to provide meaningful input and guidance to the Board, including with respect to corporate finance and customer and product support. | |||

2020 PROXY STATEMENT 17

2020 PROXY STATEMENT 17

The following table sets forth information concerning the compensation for our non-employee directors during the year ended December 31, 2019. Mr. Umpleby, who served as Chairman and CEO during 2019, did not receive separate compensation for his service on the Board.

Compensation for non-employee directors for 2019 was comprised of the following components:

|

|

|

|

Restricted Stock Units (1 Year Vesting) | $ | 150,000 |

|

Cash Retainer | $ | 150,000 |

|

Cash Stipends: |

|

|

|

Presiding Director | $ | 50,000 | (1) |

Audit Committee Chairman | $ | 30,000 | (2) |

Compensation and Human Resources Committee Chairman | $ | 25,000 | (2) |

Public Policy and Governance Committee Chairman | $ | 20,000 | (2) |

(1) Cash stipend effective January 1, 2019 (2) Cash stipend effective April 10, 2019

| |||

Directors are required to own Caterpillar common stock equal to five times their annual cash retainer. Directors have a five-year period from the date of their election or appointment to meet the target ownership guidelines. All Directors are in compliance with these guidelines. In addition, under the Company’s Directors’ Deferred Compensation Plan, directors may defer 50 percent or more of their annual cash retainer and stipend into an interest-bearing account or an account representing phantom shares of Caterpillar stock, and effective for grants made on or after January 1, 2019, directors may defer 50 percent or more of any stock-based compensation (other than options and stock appreciation rights) upon vesting into an account representing phantom shares of Caterpillar stock. Directors that joined the Board prior to April 1, 2008, also are able to participate in a Charitable Award Program, under which a donation of up to $500,000 will be made by the Company in the director’s name to charitable organizations selected by the director and a donation of up to $500,000 also will be made by the Company in the director’s name to the Caterpillar Foundation. Directors derive no financial benefit from the Charitable Award Program.

2020 PROXY STATEMENT 18

2020 PROXY STATEMENT 18

DIRECTOR COMPENSATION FOR 2019

Director | Fees Earned or Paid in Cash |

| Restricted Stock Units(2) | All Other Compensation(3) |

|

| Total | ||||

Kelly A. Ayotte | $ | 150,000 |

| $ | 149,971 |

| $ | — |

| $ | 299,971 |

David L. Calhoun | $ | 214,505 | (1) | $ | 149,971 |

| $ | — |

| $ | 364,476 |

Daniel M. Dickinson | $ | 171,758 | (1) | $ | 149,971 |

| $ | 29,657 |

| $ | 351,386 |

Juan Gallardo | $ | 150,000 |

| $ | 149,971 |

| $ | 14,725 |

| $ | 314,696 |

Dennis A. Muilenburg (4) | $ | 150,000 |

| $ | 149,971 |

| $ | — |

| $ | 299,971 |

William A. Osborn | $ | 156,992 | (1) | $ | 149,971 |

| $ | 19,725 |

| $ | 326,688 |

Debra L. Reed-Klages | $ | 150,000 |

| $ | 149,971 |

| $ | 2,000 |

| $ | 301,971 |

Edward B. Rust, Jr. | $ | 154,245 | (1) | $ | 149,971 |

| $ | 29,988 |

| $ | 334,204 |

Susan C. Schwab | $ | 150,000 |

| $ | 149,971 |

| $ | 17,000 |

| $ | 316,971 |

Miles D. White | $ | 173,750 | (1) | $ | 149,971 |

| $ | 8,000 |

| $ | 331,721 |

Rayford Wilkins, Jr. | $ | 150,000 |

| $ | 149,971 |

| $ | 5,000 |

| $ | 304,971 |

(1) Total fees earned or paid in 2019 include pro-rated Cash Stipends for directors who transitioned between committee chair positions over the course of the year. (2) As of December 31, 2019, the number of RSUs (including accrued dividend equivalent units) and Phantom Shares held by those serving as non-employee directors during 2019 was: Ms. Ayotte: 1,898 (which consists of 1,109 RSUs and 789 Phantom Shares); Mr. Calhoun: 16,598 (which consists of 1,109 RSUs and 15,489 Phantom Shares); Mr. Dickinson: 28,950 (which consists of 1,109 RSUs and 27,841 Phantom Shares); Mr. Gallardo: 36,127 (which consists of 1,109 RSUs and 35,018 Phantom Shares); Mr. Muilenburg: 1,109 (which consists of 1,109 RSUs); Mr. Osborn: 2,263 (which consists of 1,109 RSUs and 1,154 Phantom Shares); Ms. Reed-Klages: 8,212 (which consists of 1,109 RSUs and 7,103 Phantom Shares); Mr. Rust: 37,762 (which consists of 1,109 RSUs and 36,653 Phantom Shares); Ms. Schwab: 14,921 (which consists of 1,109 RSUs and 13,812 Phantom Shares); Mr. White: 11,867 (which consists of 1,109 RSUs and 10,758 Phantom Shares); and Mr. Wilkins: 1,109 (which consists of 1,109 RSUs). Mr. Calhoun, Mr. Gallardo, Ms. Reed-Klages, Ms. Schwab and Mr. White elected to defer 100 percent of their Cash Retainer and Cash Stipend (as applicable) into Phantom Shares of Caterpillar stock in the Directors’ Deferred Compensation Plan which are included in these Phantom Shares totals. | |||||||||||

(3) All Other Compensation represents amounts paid in connection with the Caterpillar Foundation’s Directors’ Charitable Award Program and the Caterpillar Political Action Committee Charitable Matching Program (CATPAC’s PACMATCH program) and administrative fees associated with the Director’s Charitable Award Program. All outside directors are eligible to participate in the Caterpillar Foundation Matching Gift Program, and eligible directors may participate in the CATPAC’s PACMATCH program annually. The Caterpillar Foundation will match contributions to eligible two-year or four-year colleges or universities, arts and cultural institutions, and public policy or environmental organizations, up to a maximum of $2,000 per eligible organization per calendar year. The amounts listed include the Charitable Foundation matching gifts as follows: Mr. Dickinson $4,000, Ms. Reed-Klages $2,000, Mr. Rust $14,000, Ms. Schwab $12,000 and Mr. White $8,000. As part of CATPAC’s PACMATCH program, Caterpillar Inc. will contribute to two charities on behalf of eligible members of the Board of Directors. The annual CATPAC’s PACMATCH match limit is $5,000. Mr. Osborn, Mr. Rust, Ms. Schwab and Mr. Wilkins had contributions matched. For directors eligible to participate in the Directors Charitable Award Program, the amounts listed represent the insurance premium and administrative fees as follows: Mr. Dickinson $25,657, Mr. Gallardo $14,725, Mr. Osborn $14,725 and Mr. Rust $10,988. (4) Mr. Muilenburg resigned from the Board effective January 26, 2020. |

BOARDELECTIONANDLEADERSHIPSTRUCTURE

Directors are elected at each annual meeting to serve for a one-year term. In uncontested elections, directors are elected by a majority of the votes cast for such directorship. If an incumbent director does not receive a greater number of “for” votes than “against” votes, such director must tender his or her resignation to the Board. In contested elections, directors are elected by a plurality vote.

The mandatory retirement age for directors is 74. Each director who will have reached the age of 74, on or before the date of the next shareholders’ meeting, shall not stand for re-election at that annual meeting of the shareholders without an express waiver by the Board.

Under Caterpillar’s bylaws, the directors annually elect a Chairman. The Board has no fixed policy on whether to have an executive or non-executive chairman and believes this determination should be made based on the best interests of the Company and its shareholders in light of the circumstances at the time. On the recommendation of the PPGC, the Board has elected D. James Umpleby III as its Chairman and David L. Calhoun as its Presiding Director.

In the role of Presiding Director, Mr. Calhoun provides strong independent oversight of management and serves as a liaison between the independent directors and the Chairman and CEO, as further described below. Mr. Calhoun also leads the Board’s annual evaluation of Mr. Umpleby, and the independent members of the Board set Mr. Umpleby’s compensation annually based on the recommendation of the Compensation and Human Resources Committee.

2020 PROXY STATEMENT 19

2020 PROXY STATEMENT 19

DUTIESANDRESPONSIBILITIESOFPRESIDINGDIRECTOR

Preside at all meetings of the Board at which the Chairman & CEO is not present, including executive sessions of the independent directors.

Serve as a liaison between the Chairman & CEO and the independent directors.

Approve the type of information sent to the Board.

Provide input and approve meeting agendas for the Board.

Approve meeting schedules, in consultation with the Chairman & CEO and the independent directors, to assure that there is sufficient time for discussion of all agenda items.

Has the authority to call meetings of the independent directors.

If requested by major shareholders, is available, when appropriate, for consultation and direct communication.

Provide the Chairman & CEO with the results of his/her annual performance review in conjunction with the chairman of the Compensation and Human Resources Committee.

The Board believes it is important to maintain flexibility as to the Board’s leadership structure. The Board will continue to regularly review its leadership structure and exercise its discretion in adopting an appropriate and effective framework to assure effective governance and accountability, taking into consideration the needs of the Board and the Company.

CORPORATEGOVERNANCEGUIDELINESANDCODEOFCONDUCT

Our Board has adopted Guidelines on Corporate Governance Issues (Corporate Governance Guidelines), which are available on our website at www.caterpillar.com/governance. The guidelines reflect the Board’s commitment to oversee the effectiveness of policy and decision-making both at the Board and management level, with a view to enhance shareholder value over the long term.

Caterpillar’s code of conduct is called Our Values in Action. Integrity, Excellence, Teamwork, Commitment and Sustainability are the core values identified in the code. Our Values in Action apply to all members of the Board and to management and employees worldwide. These values embody the high ethical standards that Caterpillar has upheld since its formation in 1925. Our Values in Action is available on our website at www.caterpillar.com/code.

The Board conducts an annual self-evaluation to determine whether the Board and its committees are functioning effectively. In 2019, the Chairman of the Public Policy and Governance Committee interviewed each Board member to solicit their feedback. The Public Policy and Governance Chairman then led a discussion during the Board’s executive session. Each of the committees of the Board followed a similar process and reported to the Board on the outcome of their self-evaluations. The self-evaluation provides the Board with actionable feedback to enhance its performance and effectiveness.

The Board has three standing committees: Audit, Compensation and Human Resources, and Public Policy and Governance. Each committee meets regularly throughout the year, reports its actions and recommendations to the Board, receives reports from management, annually evaluates its performance and has the authority to retain outside advisors at its discretion. The current primary responsibilities of each committee are summarized below and set forth in more detail in each committee’s written charter, which can be found on Caterpillar’s website at www.caterpillar.com/governance. All committee members are independent under Company, NYSE and SEC standards applicable to Board and committee service, and the Board has determined that each member of the Audit Committee is “financially literate” and an “audit committee financial expert” as defined under SEC rules.

2020 PROXY STATEMENT 20

2020 PROXY STATEMENT 20

CommitteeMembers: NumberofMeetingsin2019:10 | COMMITTEEROLESANDRESPONSIBILITIES |

■ Selects and oversees independent auditors, including annual evaluation of the lead audit partner. | |

■ Oversees our financial reporting activities, including our financial statements, annual report and accounting standards and principles. | |

■ Reviews with management the Company’s risk assessment and risk management framework. ■ Approves audit and non-audit services provided by the independent auditors. ■ Reviews the organization, scope and effectiveness of the Company’s internal audit function, disclosures and internal controls. ■ Sets parameters for and monitors the Company’s hedging and derivatives practices. ■ Provides oversight for the Company’s compliance program and Code of Conduct. ■ Monitors any significant litigation, regulatory, and tax compliance matters. ■ Oversees information technology systems and related security. ■ Reviews with management cybersecurity risks and strategy to mitigate these risks. |

COMPENSATIONANDHUMANRESOURCESCOMMITTEE

CommitteeMembers: NumberofMeetingsin2019:6 | COMMITTEEROLESANDRESPONSIBILITIES |

■ Recommends the CEO’s compensation to the Board and establishes the compensation of other executive officers. | |

■ Establishes, approves and oversees the Company’s equity compensation and employee benefit plans. | |

■ Reviews incentive compensation arrangements to ensure that incentive pay does not encourage unnecessary risk-taking, and reviews and discusses the relationship between risk management policies and practices, corporate strategy and executive compensation. | |

■ Recommends to the Board the compensation of independent directors. ■ Provides oversight of the Company’s diversity and immigration practices and employee relations. ■ Furnishes an annual Committee Report on executive compensation and approves the Compensation Discussion and Analysis section in the Company’s proxy statement. |

PUBLICPOLICYANDGOVERNANCECOMMITTEE

CommitteeMembers: NumberofMeetingsin2019:6 | COMMITTEEROLESANDRESPONSIBILITIES |

■ Makes recommendations to the Board regarding the size and composition of the Board and its committees, and the criteria to be used for the selection of candidates to serve on the Board. | |

■ Discusses and evaluates the qualifications of potential and incumbent directors and recommends the director candidates to be nominated for election at the Annual Meeting. | |

■ Leads the Board in its annual self-evaluation process. ■ Oversees the Company’s senior executive succession planning. ■ Oversees the Company’s environmental, health and safety activities and sustainability. ■ Oversees the Company’s corporate governance. ■ Reviews/advises on matters of domestic and international public policy affecting the Company’s business, such as trade policy and international trade negotiations and major global legislative and regulatory developments. ■ Annually reviews the Company’s charitable contributions to the Caterpillar Foundation and political contributions and policies. ■ Oversees investor, customer, community and government relations. |

2020 PROXY STATEMENT 21

2020 PROXY STATEMENT 21

DIRECTORINDEPENDENCEDETERMINATIONS

The Company’s Guidelines on Corporate Governance GuidelinesIssues establish that no more than two non-independent directors may serve on the Board at any point in time. A director is “independent” if he or she has no direct or indirect material relationship with the Company or with senior management of the Company and their respective affiliates. Annually, the Board makes an affirmative determination regarding the independence of each director based upon the recommendation of the PPGCandPPGC and in accordance with the standards in the Company’s Guidelines on Corporate Governance Guidelines,Issues, which are available on our website at www.caterpillar.com/governance.governance.

Applying these standards, the Board determined that each of the director nominees, and all other directors who served during 2019, met the independence standards except JimMr. Umpleby, who is a current employee of the Company.

COMMUNICATIONWITHTHEBOARDCOMMUNICATION WITH THE BOARD

Shareholders, employees and all other interested parties may communicate with any of our directors individually, our Board as a group, our independent directors as a group or any Board committee as a group by email or regular mail:

|   |

BY EMAIL | BY MAIL |

send an email to |

|

While the Board oversees management, it does not participate in day-to-day management functions or business operations. If you wish to submit questions or comments relating to these matters, please use the Contact Us form on our website at www.caterpillar.com/contact, which will help direct your message to the appropriate area of our Company.

All communications regarding personal grievances, administrative matters, the conduct of the Company’s ordinary business operations, billing issues, product or service related inquiries, order requests and similar issues will be directed to the appropriate individual within the Company. The Chairman of the Board has instructed the Chief Legal Officer, General Counsel and Corporate Secretary to consult with him if heshe is unsure who should receive the communication. If a legitimate communication is sent, you will receive a written acknowledgement from the Corporate Secretary’s office confirming receipt of your communication.

Contacting Caterpillar. While the Board oversees management, it does not participate in day-to-day management functions or business operations. If you wish to submit questions or comments relating to these matters, please use the Contact Us form on our website at www.caterpillar.com/contact, which will help direct your message to the appropriate area of our Company.

|

|

Table of ContentsINVESTOROUTREACH

We conduct an annual governance review and shareholder outreach throughout the year to ensure that management and the Board understand and consider the issues that matter most to our shareholders and reflect the insights and perspectives of our many stakeholders.

WHO PARTICIPATES IN THE INVESTOR OUTREACH PROGRAM? | IN WHAT TYPES OF ENGAGEMENT DOES THE COMPANY PARTICIPATE? | ||||

■ Board of Directors ■ Senior Management ■ Investor Relations ■ Corporate Secretary | ■ Investor conferences ■ One-on-one meetings ■ Earnings calls ■ Investor and analyst calls | ||||

Third parties regularly recognize our employees’ innovation, leadership and workplace satisfaction. We are pleased to highlight some of these 2016 awards here.

|  |

Table of ContentsPOLITICALCONTRIBUTIONSANDLOBBYING

Caterpillar has set aspirational goals for its operations and product stewardship. We believe these standards affirm our determination to lead our industry to a more sustainable future. You can track our progress towards achieving these goals by visiting our website www.caterpillar.com/sustainability.

POLITICAL CONTRIBUTIONS AND LOBBYING

The actions that governments take can impact the Company, our employees, customers and shareholders. It is important for government leaders to understand the impact of such actions. For this reason, the Company participates in the political process and advocates in a responsible and constructive manner on issues that advance the Company’s goals and protect shareholder value.

To promote transparency and good corporate citizenship, the Company provides voluntary disclosure relating to theits political contribution activities of the Company and its political action committee, its engagement in public policy issues and global issues of importance to the Company, including detailed information on the Company’s position with respect to such issues. This information is disclosed on our website

|

|

at www.caterpillar.com/contributions and includes an itemized list of organizations and individuals that received political contributions from Caterpillar or the Caterpillar Political Action Committee. It also includes a summary of some of the public policy issues important to the Company that may cause us to engage in public advocacy.

Caterpillar’s political and advocacy activities at both the state, federal and federalinternational levels are managed by the Vice President, Global Government & Corporate Affairs, who coordinates andreviewsand reviews with senior management the legislative and regulatory priorities that are significant to the Company’s business, and shareholders, as well as related advocacy activities. To ensure appropriate Board oversight of political activities, the Board’s Public Policy and Governance Committee receives regular briefingsreviews the Company’s policy on political activities and contributions and Caterpillar’s significant political activities, including corporate political contributions, political contribution activities of the Company’sCaterpillar Political Action Committee, trade association participation and Caterpillar’s legislative and regulatory priorities, the Company’s political spending and trade association expenditures as well as the activities of Caterpillar’s Political Action Committee.priorities.

RELATEDPARTYTRANSACTIONSRELATED PARTY TRANSACTIONS

Caterpillar has a written processpolicy governing the approval of transactions with the Company that are expected to exceed $120,000 in any calendar year in which any director, executive officer or their immediate family members will have a direct or indirect material interest. Under the process,policy, all such transactions must be approved in advance or ratified by the PPGC.

Prior to entering into such a transaction, theThe director or officer must submit the details of the proposed transaction to the Company’s Chief Legal Officer, General Counsel and Corporate Secretary, including whether the related person or his or her immediate family member has or will haveahave a direct or indirect interest (other than solely as a result of being a director or a less than 10 percent beneficial owner of an entity involved in the transaction). The Chief Legal Officer, General Counsel and Corporate Secretary will then submit the matter to the PPGC for its consideration.

The Board concluded that each director, other than Mr. Umpleby, is independent.From time to time, related persons of Caterpillar may purchase products or services of the Company and its subsidiaries. In reaching this determination the Board considered,connection with respectthese purchases, Caterpillar may provide marketing support directly or indirectly through independent dealers, consistent with sales under similar circumstances to Ms. Reed, ordinary course business between Sempra Energy and Caterpillar involving the purchase or sale of equipment, engines and energy.unaffiliated third parties.

|  |

PROPOSAL 2 – RATIFICATION OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

PROPOSAL SNAPSHOT

| ||

| ||

|

| |

What am I voting on?

Shareholders are being asked to approve the ratification of the Audit Committee’s appointment of PricewaterhouseCoopers (PwC) as the Company’s independent auditor for 2020.

Board Voting Recommendation:

FOR the ratification of our independent registered public accounting firm.

The Audit Committee (AC) is directly responsible for the appointment, compensation, retention and oversight of the Company’s independent auditor. PricewaterhouseCoopersPwC has been ourCaterpillar’s independent auditor since 1925. Through its extensive experience with the Company, PwC has gained institutional knowledge and a deep understanding of the Company’s operations and business, accounting policies and practices and internal control over financial reporting. The Audit CommitteeAC believes that the retention of PricewaterhouseCoopersPwC to serve as the Company’s independent auditor is in the best interests of the Company and its shareholders. If the appointment of PricewaterhouseCoopersPwC is not approved by the shareholders, the Audit CommitteeAC will consider whether it is appropriate to select another independent auditor.

Representatives of PricewaterhouseCoopersPwC will be present at the Annual Meeting and will have the opportunity to make a statement if they desire to do so. The representatives will also be available to respond to questions at the meeting.

AUDITFEESANDAPPROVALPROCESSAUDIT FEES AND APPROVAL PROCESS

The Audit CommitteeAC pre-approves all audit and non-audit services to be performed by the independent auditors in compliance with the Sarbanes-Oxley Act and the SECSecurities and Exchange Commission (SEC) rules regarding auditor independence. The policies and procedures are detailed as to the particular service and do not delegate the Audit Committee’sAC’s responsibility to management. The policies and procedures address any service provided by the independent auditors and any audit or audit-related services to be provided by any other audit service provider. The pre-approval process includes an annual and interim component.

Annually, not later than February of each year, management and the independent auditors jointly submit a service matrix of the types of audit and non-audit services that management may wish to have the independent auditor perform for the current year. The service matrix categorizes the types of services byaudit,by audit, audit-related, tax and all other services. Management and the independent auditors jointly submit an annual pre-approval limits request. The request lists aggregate pre-approval limits by service category. The request also lists known or anticipated services and associated fees. The Audit CommitteeAC approves or rejects the pre-approval limits and each of the listed services on the service matrix.

During the course of the year, the Audit CommitteeAC chairman has the authority to pre-approve requests for services that were not approved in the annual pre-approval process. However, all services, regardless of fee amounts, are subject to restrictions on the services allowable under the Sarbanes-Oxley Act and SEC rules regarding auditor independence. In addition, all fees are subject to ongoing monitoring by the Audit Committee.AC.

2020 PROXY STATEMENT 24

2020 PROXY STATEMENT 24

INDEPENDENTREGISTEREDPUBLICACCOUNTINGFIRMFEEINFORMATION

Fees for professional services provided by our independent auditor included the following (in millions):

| 2016 | 2015 | ||||||

| Audit Fees1 | $ | 33.3 | $ | 32.0 | |||

| Audit-Related Fees2 | 1.2 | 1.3 | |||||

| Tax Compliance Fees3 | 0.4 | 0.4 | |||||

| Tax Planning And Consulting Fees4 | 0.1 | 0.2 | |||||

| All Other Fees5 | 0.1 | 19.8 | |||||

| TOTAL | $ | 35.1 | $ | 53.7 | |||

|

|

|

|

| 2019 | 2018 | |

Audit Fees(1) |

| $ | 35.5 |

| 33.6 |

Audit-Related Fees(2) |

|

| 0.6 |

| 1.6 |

Tax Compliance Fees(3) |

|

| 0.1 |

| 0.5 |

Tax Planning And Consulting Fees(4) |

|

| 0.1 |

| 0.1 |

All Other Fees(5) |

|

| 0.1 |

| 0.2 |

TOTAL |

| $ | 36.4 | $ | 36.0 |

(1) “Audit Fees” principally includes audit and review of financial statements (including internal control over financial reporting), statutory and subsidiary audits, SEC registration statements, comfort letters and consents. (2) “Audit-Related Fees” principally includes attestation services requested by management, accounting consultations, pre- or post-implementation reviews of processes or systems and audits of employee benefit plan financial statements. Total fees paid directly by the benefit plans, and not by the Company, were $0.6 million in each of 2019 and 2018 and are not included in the amounts shown above. (3) “Tax Compliance Fees” includes, among other things, statutory tax return preparation and review and advice on the impact of changes in local tax laws. (4) “Tax Planning and Consulting Fees” includes, among other things, tax planning and advice and assistance with respect to transfer pricing issues. (5) “All Other Fees” consists principally of license-based services for statutory audit monitoring and accounting and reporting literature research. | |||||

Table of ContentsANONYMOUSREPORTINGOFACCOUNTINGANDOTHERCONCERNS

1 “Audit Fees” principally includes audit and review of financial statements (including internal control over financial reporting), statutory and subsidiary audits, SEC registration statements, comfort letters and consents.2 “Audit-Related Fees” principally includes attestation services requested by management, accounting consultations, pre- or post- implementation reviews of processes or systems and audits of employee benefit plan financial statements. Total fees paid directly by the benefit plans, and not by the Company, were $0.6 million in 2016 and $1.0 million in 2015 and are not included in the amounts shown above.3 “Tax Compliance Fees” includes, among other things, statutory tax return preparation and review and advice on the impact of changes in local tax laws.4 “Tax Planning and Consulting Fees” includes, among other things, tax planning and advice and assistance with respect to transfer pricing issues.5 “All Other Fees” consist principally of strategy consulting services provided by Booz & Company, which was acquired by PricewaterhouseCoopers in 2014 and renamed Strategy&. The Company stopped engaging Strategy& in 2015.

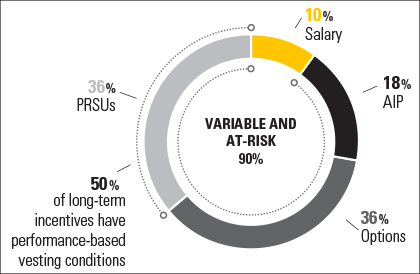

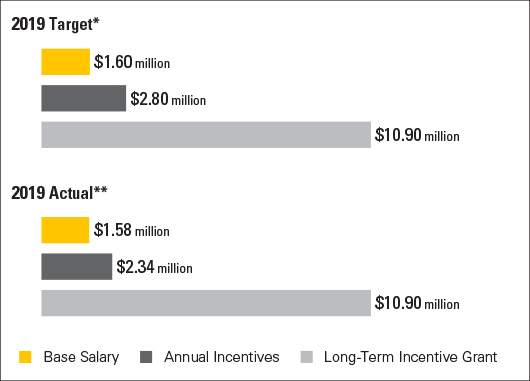

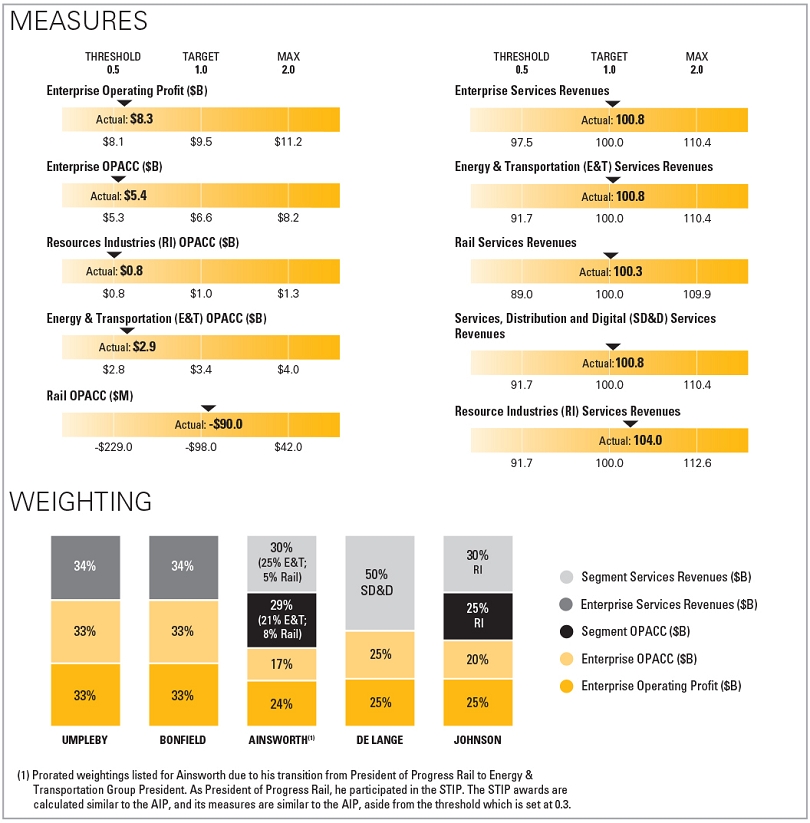

ANONYMOUS REPORTING OF ACCOUNTING CONCERNS